Personalized Medicare Solutions: Medicare Supplement Plans Near Me

Selecting the Right Medicare Supplement for Your Insurance Plan

When it comes to ensuring extensive medical care coverage, picking the appropriate Medicare supplement plan is a critical decision that calls for careful consideration. By taking the time to study and analyze these aspects, you can with confidence secure a Medicare supplement strategy that ideal suits your insurance plan and gives the protection you need.

Recognizing Medicare Supplement Plans

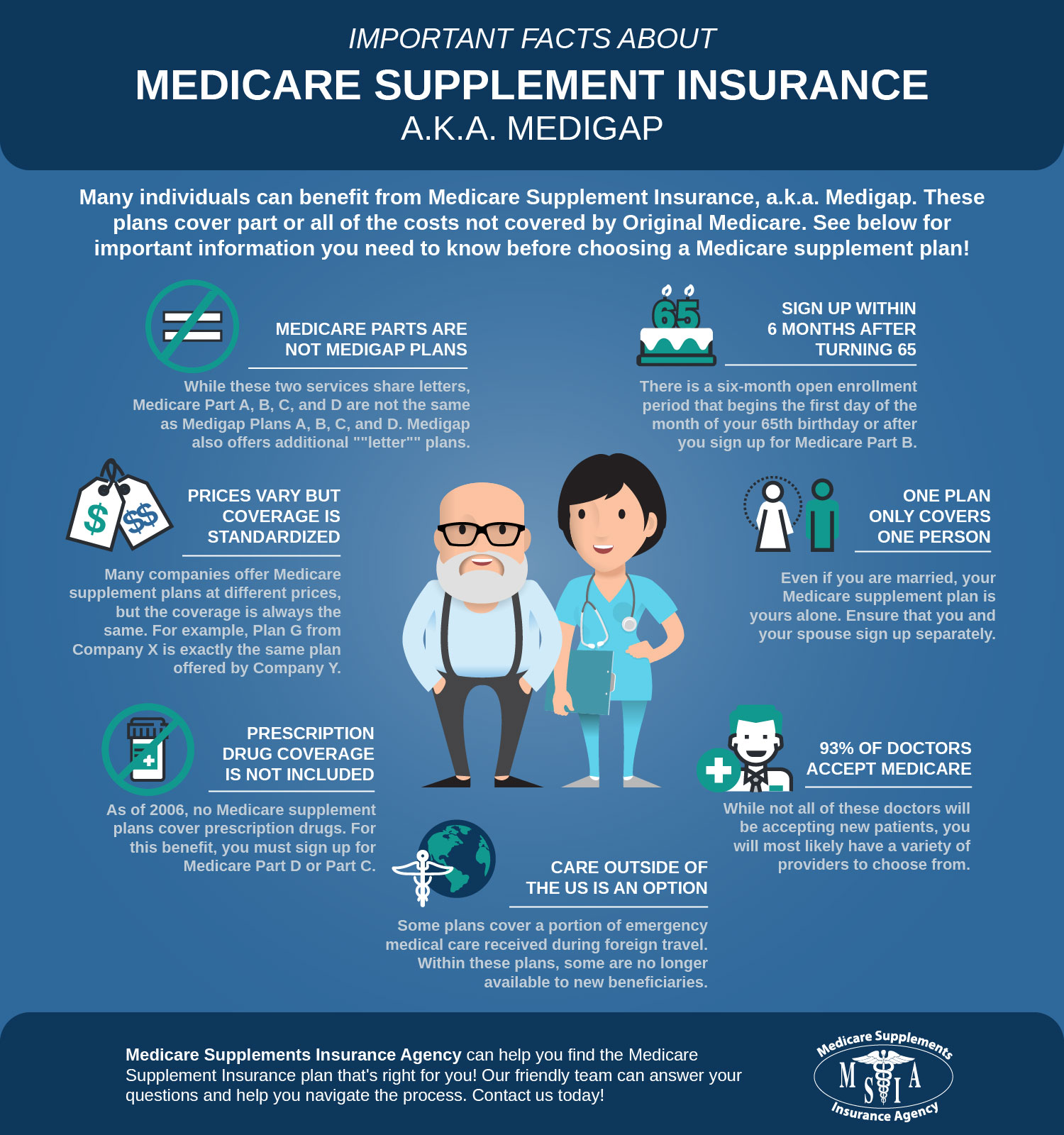

When navigating the intricacies of Medicare, people typically locate themselves considering various Medicare Supplement prepares to enhance their existing coverage. Medicare Supplement prepares, additionally known as Medigap policies, are used by exclusive insurance companies to aid cover the gaps in Original Medicare, including copayments, coinsurance, and deductibles. These strategies are standardized and identified with letters, such as Strategy A, Fallback, approximately Strategy N, each supplying various degrees of insurance coverage.

It is essential for individuals to understand that Medicare Supplement intends job along with Initial Medicare and can not be utilized as standalone protection. Moreover, these strategies normally do not consist of prescription medication protection; individuals may require to sign up in a different Medicare Component D strategy for prescription medicines.

When examining Medicare Supplement prepares, it is important to compare the benefits offered by each strategy, in addition to the connected expenses. Premiums, protection options, and service provider networks can vary between insurance coverage companies, so people need to thoroughly evaluate and compare their options to select the plan that finest satisfies their healthcare demands and budget plan.

Examining Your Healthcare Needs

Contrasting Strategy Options

Upon assessing your health care requires, the following step is to compare the different Medicare Supplement strategy alternatives readily available to determine the most appropriate insurance coverage for your medical costs (Medicare Supplement plans near me). When contrasting strategy options, it is necessary to take into consideration variables such as coverage benefits, expenses, and service provider networks

First of all, check out the protection advantages provided by each strategy. Different Medicare Supplement plans supply varying levels of coverage for services like medical facility stays, competent nursing care, and doctor gos to. Evaluate which advantages are crucial to you based upon your health care demands.

Secondly, contrast the prices connected with each plan. This includes month-to-month costs, deductibles, copayments, and coinsurance. Medicare Supplement plans near me. Comprehending the total cost of see this site each strategy will certainly help you make an informed choice based on your budget and economic scenario

Last but not least, consider the copyright networks connected with the strategies. Some Medicare Supplement plans might restrict you to a network of doctor, while others permit you to see any type of medical professional who approves Medicare patients. Make sure that your preferred health care providers are in-network to prevent unanticipated out-of-pocket expenses.

Examining Prices and Coverage

To make an educated choice on selecting the most suitable Medicare Supplement plan, it is important to completely evaluate both the costs connected with each strategy and the protection advantages they use. On the other hand, greater costs plans may use even more thorough insurance coverage with reduced out-of-pocket expenditures.

Along with costs, very carefully assess the insurance coverage advantages supplied by each Medicare Supplement strategy - Medicare Supplement plans near me. Different plans offer differing levels of insurance coverage for solutions such as health center keeps, competent nursing care, and outpatient treatment. See to it the strategy you choose aligns with your medical care requirements and budget plan. It's likewise necessary to check if the strategy consists of additional benefits like vision, oral, or prescription drug insurance coverage. By reviewing both expenses and coverage, you can pick a Medicare Supplement strategy that satisfies your financial and medical care requirements properly.

Enrolling in a Medicare Supplement Strategy

To be qualified for a Medicare Supplement plan, people must be registered in Medicare Component A and Part B. Normally, the best time to register in a Medicare Supplement plan is throughout the open registration period, which begins when a specific turns 65 or older and is signed up in Medicare Component B. Throughout this period, insurance coverage business are typically navigate to these guys not allowed to deny coverage or cost greater premiums based on pre-existing conditions. linked here It is essential to be aware of these registration durations and eligibility criteria to make an educated choice when choosing a Medicare Supplement plan that best matches private health care needs and economic conditions.

Verdict

In verdict, selecting the proper Medicare Supplement strategy calls for a comprehensive understanding of your health care requires, contrasting numerous strategy options, and evaluating costs and protection. It is essential to sign up in a strategy that straightens with your specific requirements to guarantee detailed wellness insurance policy protection. By meticulously analyzing your alternatives and picking the appropriate strategy, you can safeguard the essential assistance for your clinical costs and health care requirements.